Unfortunately for taxpayers, moving expenses are no longer tax-deductible when moving for work. IRS moving deductions are no longer allowed under the new tax law

For more information on how IRS moving deductions worked prior to tax reform, check here. Those moving were not allowed to deduct: the cost of buying or renting a new home the cost of meals and food while on the road the cost of house-hunting or pre-move visits and any expenses that were already reimbursed by an employer.

#Ca change resident moving expenses tax deduction professional

The cost of hiring professional movers and/or packers.However, these expenses must have been necessary for your move. If you met the above requirements, you could deduct certain moving expenses from your federal income taxes.

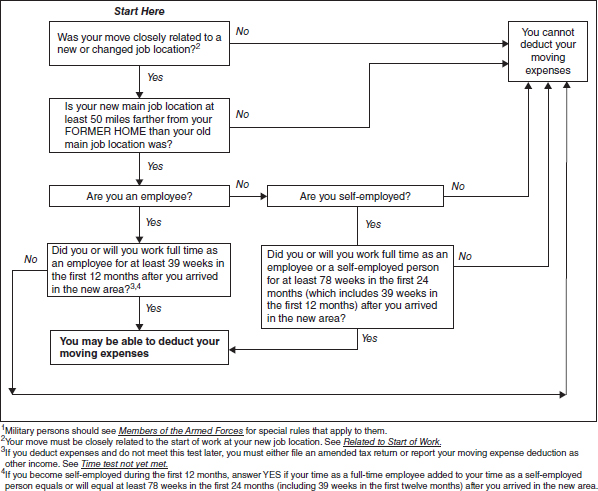

The distance requirement – In order to prove that you were moving for work, the commute from the old home to the new job location had to be at least 50 miles longer than the old commute.This meant that taxpayers had to be working full-time at the new job for at least 39 weeks within the first year of moving. The time requirement – The move had to be closely related to the start of work.The requirements for classifying it as a job-related move included: The IRS allowed these moving deductions only when the person was moving for job-related reasons. Prior to the Tax Cuts and Jobs Act, taxpayers moving for a job were allowed to claim moving expense deductions on their taxes. Allowable IRS moving deductions before tax reform To get you up to speed with the ins and outs of the new tax law and how it affects those moving, read our guide to IRS moving deductions before and after tax reform, below. The majority of tax reform changes take effect in 2018 for tax returns filed in 2019. According to the IRS, “in addition to lowering the tax rates, some of the changes in the law that affect you and your family include increasing the standard deduction, suspending personal exemptions, increasing the child tax credit, and limiting or discontinuing certain deductions.” While the new law lowers tax rates for many, it also eliminates any tax-deductible moving expenses. In 2017 the Tax Cuts and Jobs Act was signed into law, affecting both individuals and businesses. Now, thanks to tax reform, the majority of taxpayers will no longer be able to claim a deduction on moving expenses. Under the previous law, those moving for work could deduct the cost of movers, travel and other moving expenses from their federal income taxes. Moving for work? You may want to brush up on the latest tax rules and regulations regarding moving expenses.

0 kommentar(er)

0 kommentar(er)